- +44-208-922-0095

- info@tulasystems.com

MTD VAT - It's Official - Tula System Limited is MTD Compliant.

MTD VAT - Making Tax Digital VAT

Tula Systems Ltd is proud to announce that our Accounting Software TulaRX has passed HMRC for MTD VAT and recognised by HMRC.

Digital account

MTD mandates recording transactional information digitally in an online account. With TulaRX already in the cloud, it acts as a single repository to store company details, transactional values, and VAT returns.

VAT filing step-by-step

Submitting VAT returns to HMRC with TulaRX is just a three step process—activate, fetch period, reconcile return, and submit. Let’s get into the nuts and bolts of the process.

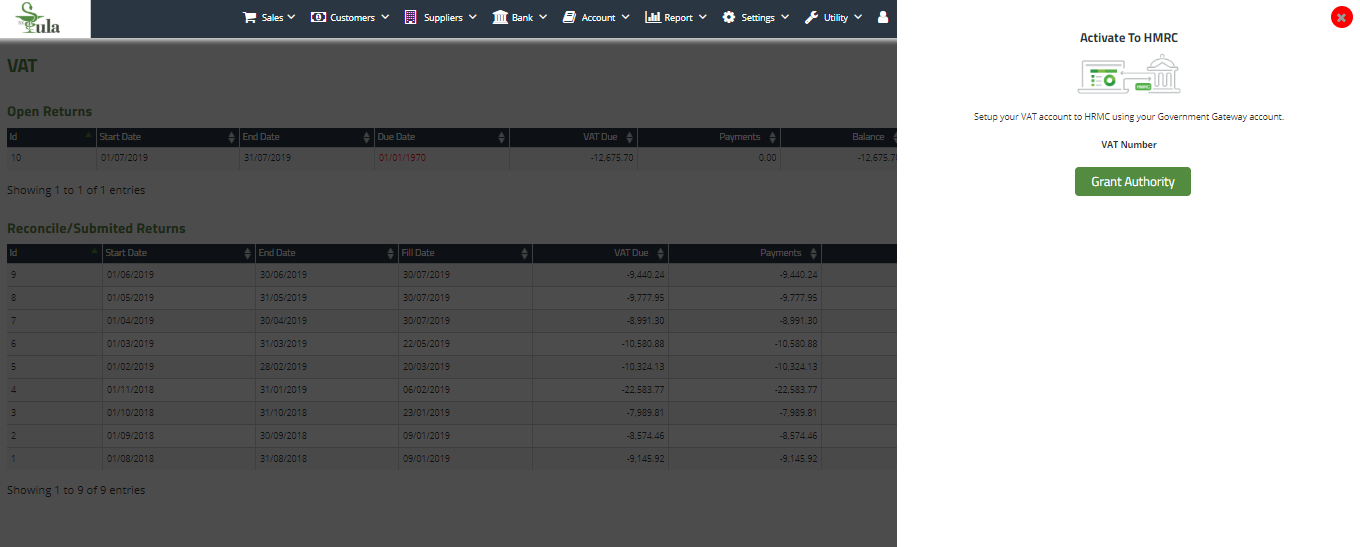

Step 1: Activate To HMRC.

Click VAT modules from the top. Grant Authority to TulaRX using government gateway ID and Password. It’s one time processor.

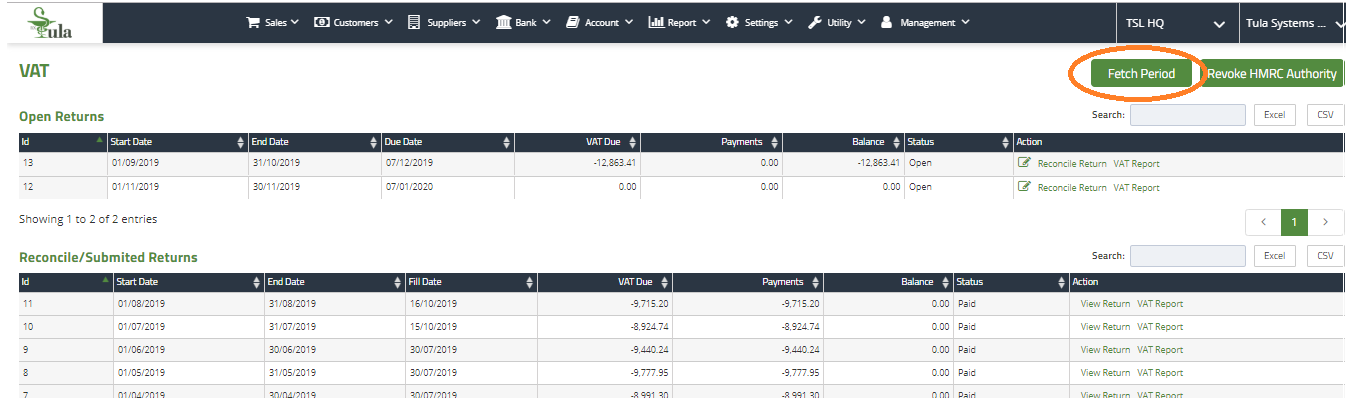

Step 2: Fetch Period

Fetch Open VAT period.

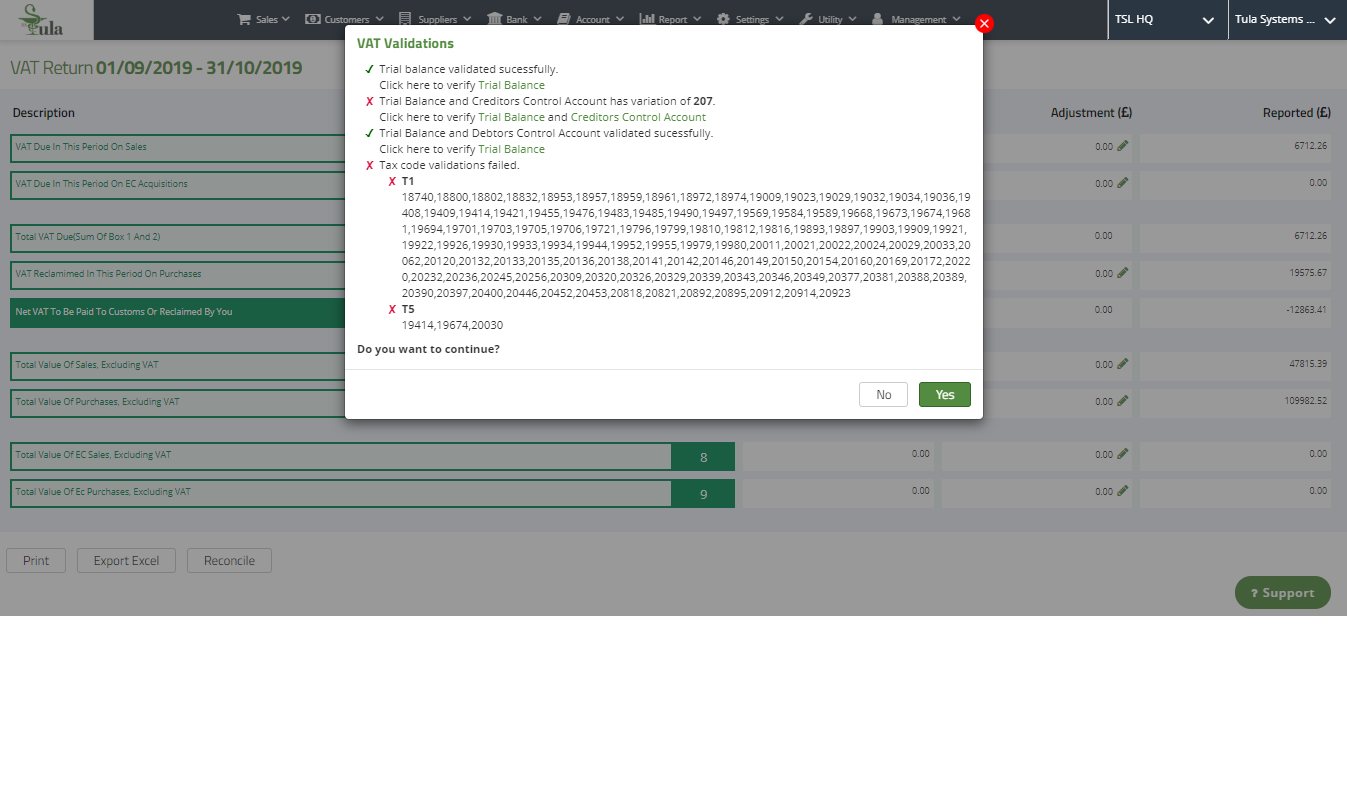

Step 3: Reconcile Return/ VAT Report

Assess the values populated in the report before submitting the returns. In case of any discrepancy, TulaRX lets you edit returns to ensure that the numbers submitted are error-free. Reconcile process will Validate Trial Balance, Creditor Control Account, Debtors Control Account and Tax Codes for any discrepancies.

Step 4: Submit Return to HMRC

When the data is reviewed and finalised, push it to the HMRC portal directly from TulaRX, with the click of a button. Print VAT Report for Business.

If you have questions, send an email on info@tulasystems.com